Mortgage Rates Just Dropped — What It Means for the Oklahoma City Market

Mortgage Rates Just Dropped — What It Means for Buyers, Sellers, and Homeowners in the OKC Market

📅 Posted April 2025 by Will Flanagan Realty Group

Mortgage rates just hit their lowest point in over a year, and if you’re in or around Oklahoma City, this could be one of the best opportunities we’ve seen in a while.

Whether you’re planning to buy, sell, invest, or refinance, understanding how this shift affects your real estate strategy is key.

Let’s break it down — both nationally and right here in OKC.

📉 What’s Driving This Rate Drop?

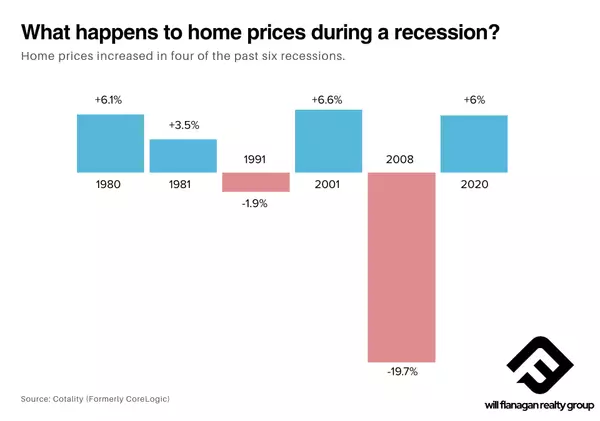

As of April 3, 2025, the average 30-year fixed mortgage rate dropped to around 6.22%, according to Mortgage News Daily. That’s the lowest level since early 2023 — and it’s largely due to declines in the 10-year Treasury yield, a key indicator for mortgage rate trends.

The Federal Reserve hasn’t officially cut rates yet, but soft inflation numbers and signs of a cooling job market have investors betting that cuts are coming. That speculation is already pushing mortgage rates down — giving buyers and sellers a real-time opportunity.

🏡 How This Impacts OKC Buyers

In Oklahoma County, the median sale price for a home in March 2025 was $239,000 — up about 2.8% year-over-year (MLSOK). But the big story? With lower mortgage rates, your monthly payment just got cheaper, or your buying power just went up — possibly by $10,000 to $25,000, depending on your loan size.

Here’s what that means:

-

More home for the money — that neighborhood you thought was out of reach may now be on the table.

-

Better negotiation leverage — fewer buyers = more room to negotiate, especially on homes that have been sitting.

-

More favorable financing terms — particularly for FHA, VA, or first-time buyers.

✅ Start searching homes in OKC now

✅ Get connected to a trusted local lender

🏠 Why OKC Sellers Should Pay Attention

Here’s the local angle: inventory in the OKC metro is still tight — hovering around 2.1 months of supply, which is below a balanced market (MLSOK Data, March 2025). When rates drop, buyers re-enter the market fast, increasing demand just as spring listings begin to ramp up.

This combo creates a sweet spot for sellers:

-

More traffic on listings

-

Faster offers from motivated buyers

-

Better chance to sell without price drops or repairs

If your home is clean, priced well, and marketed properly, you could walk away with a stronger offer — especially before inventory spikes later this summer.

💰 Find out what your home is worth now

📈 Let’s talk strategy for selling in spring 2025

🏘️ For Homeowners: Refinance or Reinvest?

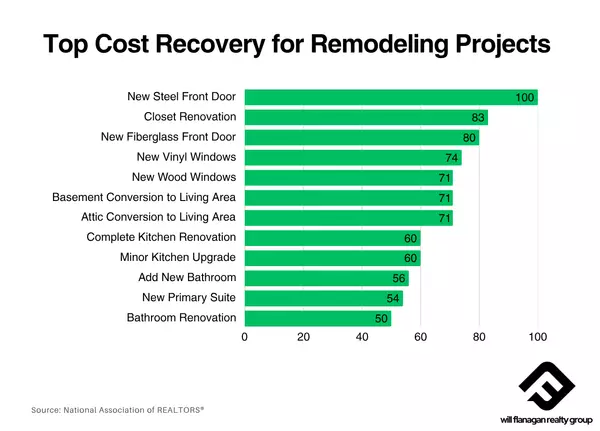

Even if you’re staying put, lower rates can unlock opportunity. This may be the right time to:

-

Refinance (if your current rate is above 7%)

-

Tap into equity to buy an investment property or vacation home

-

Restructure debt with a lower monthly payment

Oklahoma homeowners saw an average equity increase of 6.2% over the past year, based on CoreLogic’s Homeowner Equity Report. That’s money you might be able to put to work.

📊 Want to explore your equity options? Let’s talk.

🔎 Local Insights from Will Flanagan Realty Group

We don’t do generic. We dive deep into local data, trends, and timing so you can make real moves — not just guesses.

Oklahoma City Real Estate Market – April 2025 Highlights:

-

Median Home Price: $239,000 (MLSOK)

-

Average Days on Market: 26

-

Inventory: 2.1 months

-

Rate Trend: 6.22% and falling (Mortgage News Daily)

This is the kind of market where the right advice can save (or earn) you thousands.

🗓️ Let’s Chat About Your Game Plan

Whether you’re planning to buy, sell, or just curious what this all means for you — we’re here for the strategy, the numbers, and the next step.

📞 Call or text us at 405-784-6580

📧 Email: will@willflanaganrealty.com

📸 Instagram: @okc_realtor_

🔁 Share This Post!

Feel free to forward this to a friend, co-worker, or family member who might benefit from the current market shift. Knowledge is power — and this rate drop is a powerful one.

Categories

Recent Posts

GET MORE INFORMATION

Managing Partner | Realtor | License ID: 183611

+1(405) 784-6580 | will@willflanaganrealty.com