Buying a Home in a Shrinking Economy: What You Need to Know

A shrinking economy. Rising mortgage rates. Flatlining prices.

If you’ve been thinking about buying a home in 2025, it’s no wonder you’re feeling hesitant. For many buyers, the instinct right now is to wait it out and see what happens before making a big move.

And the headlines don’t help:

The U.S. Bureau of Economic Analysis just reported a 0.3% drop in GDP in Q1 2025, following a strong 2.4% gain at the end of 2024. It’s the kind of data point that makes people pause.

But smart buyers aren’t freezing. They’re asking the right questions, gathering the data, and making a plan.

A Simple 3-Step Plan for Buyers in 2025

Step 1: Get Clear on What’s Actually Worrying You

A lot of buyers right now are saying the same thing:

“I think I just want to wait and see what happens with the economy. I don’t want to make a mistake.”

That makes total sense. Buying a home is a major decision, and when the economy feels uncertain, it’s natural to question what comes next.

But instead of freezing, try asking yourself: What specifically is making me nervous?

Is it interest rates? Prices? Job security? Timing?

Once you pinpoint the real concern, it becomes easier to talk through your options and make decisions based on facts, not fear.

Step 2: Understand What the Market Is Actually Doing

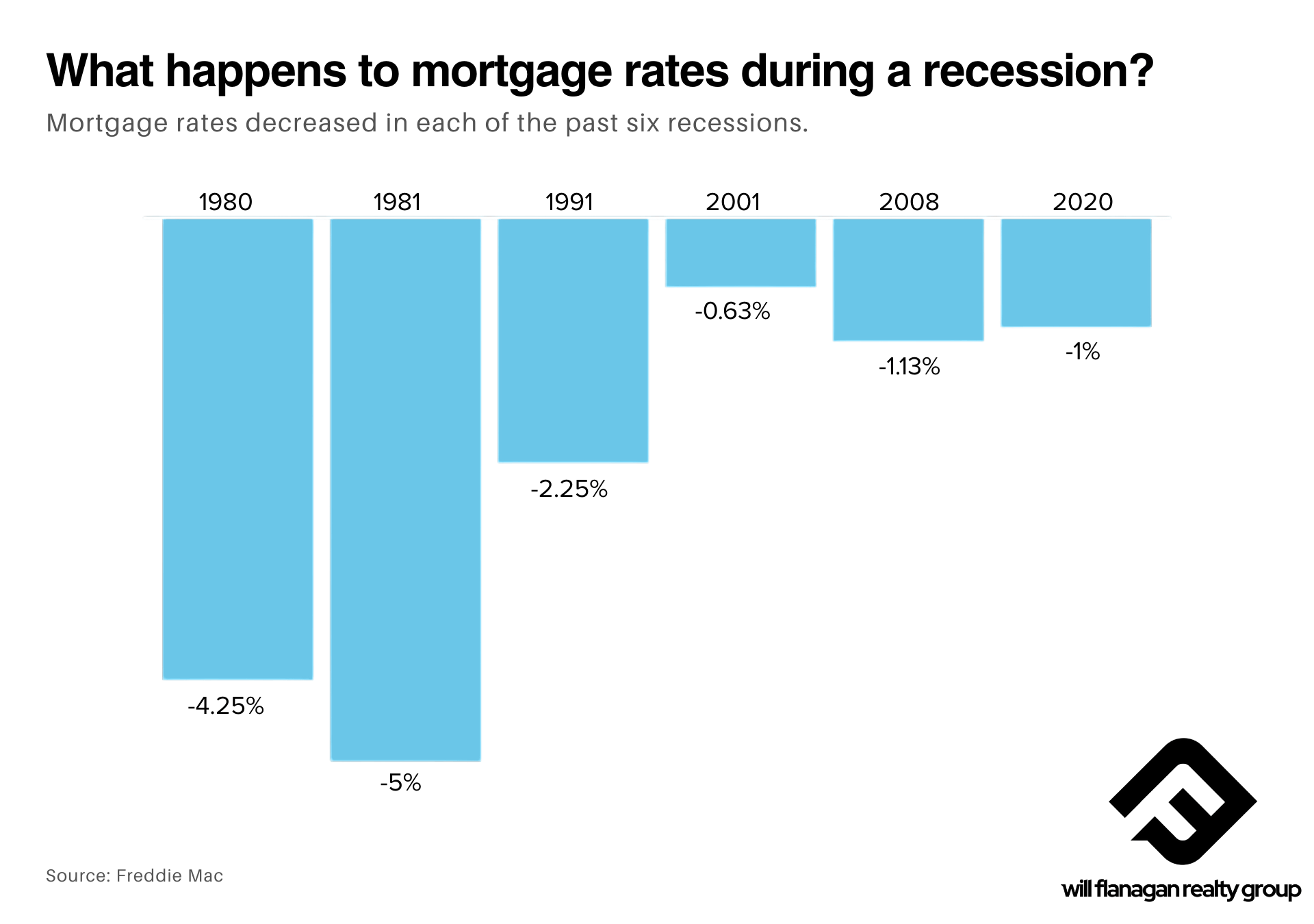

Right now, many buyers assume that prices will crash or rates will suddenly drop. But that’s not what the data is showing.

According to the April 2025 housing report from Realtor.com, we’re seeing some shifts that benefit buyers:

-

-

Inventory is up 30.6% year-over-year, giving you more choices and less competition.

-

18% of listings had price reductions in April, the highest share for any April since at least 2016.

-

Homes are sitting longer, with a median of 50 days on market — four more than a year ago.

-

The national median list price is holding steady at $431,250, with price per square foot up just 1.1%

-

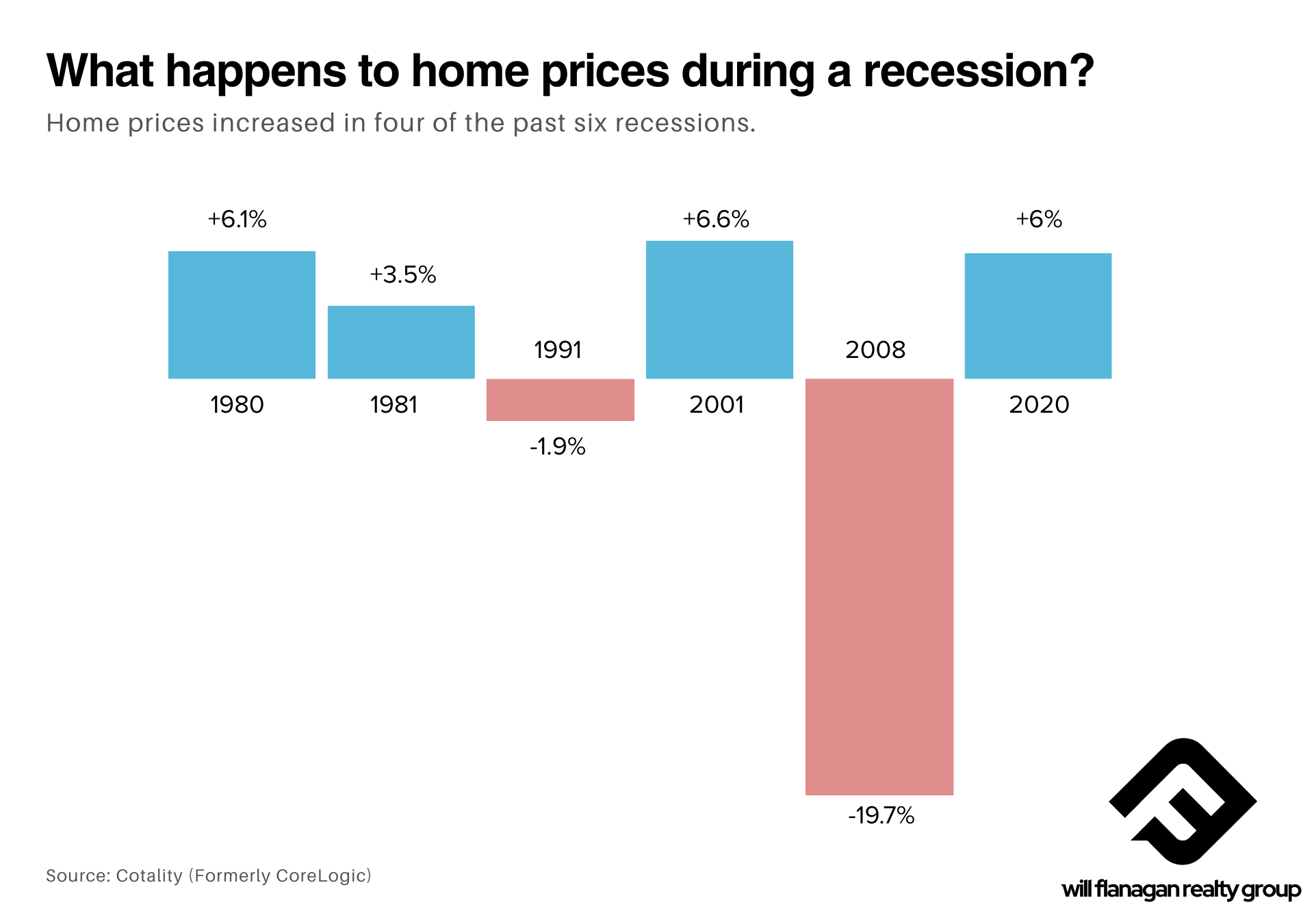

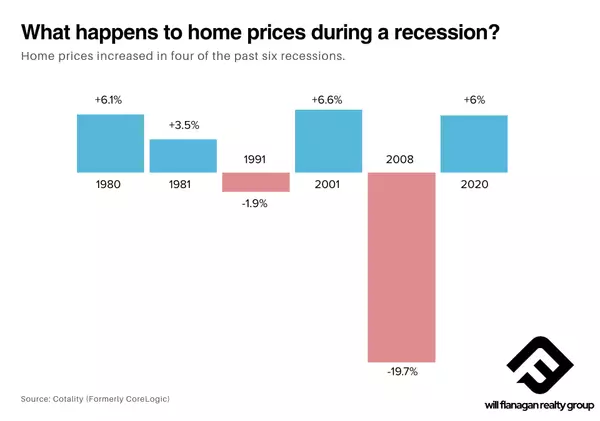

These aren’t the signals of a market crash. In fact, in four of the last six recessions, home prices actually went up.

Now, let’s zoom in on Oklahoma City

Here’s what’s happening on the ground right here in Oklahoma County:

-

-

-

Inventory is up 22.4% year-over-year, giving buyers more breathing room.

-

Price reductions were seen on 20.1% of all active listings in March.

-

Median days on market was 31 days, up slightly from 26 this time last year.

-

The median sold price came in at $265,000, holding steady compared to last quarter.

-

-

In other words, homes are still moving — but buyers are regaining some leverage.

Whether you’re eyeing Edmond, the Plaza District, or the east side of OKC, the trends are consistent: stable pricing, more inventory, and room to negotiate. Real estate is always local, and here in Oklahoma City, opportunity is very much alive.

(📊 Need the full local market breakdown? You can grab my latest OKC snapshot here: willflanaganrealty.com/snapshot)

Step 3: Build a Plan

No matter what your timeline is, planning is key.

If you’re looking to buy within the next 18 months, you have two clear options:

-

-

Option 1: Create a 6–12 month plan where you rent, save, and watch the market closely.

-

Option 2: Explore what’s available right now and see if there’s an opportunity to buy with less competition while others are still hesitating.

-

Neither option is wrong.

I’ll leave you with this — it’s easy to let uncertainty take over when the news cycle is loud. But often, the smartest moves are made when we stay grounded in facts, focused on long-term goals, and open to possibility.

🎯 Ready to explore your options in OKC?

Whether you’re 30 days or 13 months from buying, having a plan matters. Let’s talk about your goals, walk through the numbers, and see if the timing makes sense for you.

📲 Schedule a no-pressure consult today at willflanaganrealty.com/consult or shoot me a text at 405-784-6580.

Smart moves start with smart conversations.

Categories

Recent Posts

GET MORE INFORMATION

Managing Partner | Realtor | License ID: 183611

+1(405) 784-6580 | will@willflanaganrealty.com