Why Real Estate Could Be Entering a ‘Supercycle’—and What That Means for You

Is Now the Time to Invest in Real Estate? Here’s What Experts Are Saying

Real estate has long been one of the most reliable wealth-building tools, but according to some of the biggest industry players, we could be on the verge of something even bigger:

A real estate supercycle.

Unlike short-term market fluctuations, a supercycle is a prolonged period of sustained growth driven by high demand, economic fundamentals, and policy changes that fuel appreciation for years to come.

Chad Tredway, Head of Real Estate Americas at J.P. Morgan Asset Management, recently explained on Bloomberg The Close that these forces, combined with eventual interest rate declines, could create one of the strongest long-term opportunities in real estate.

What Is a Real Estate Supercycle?

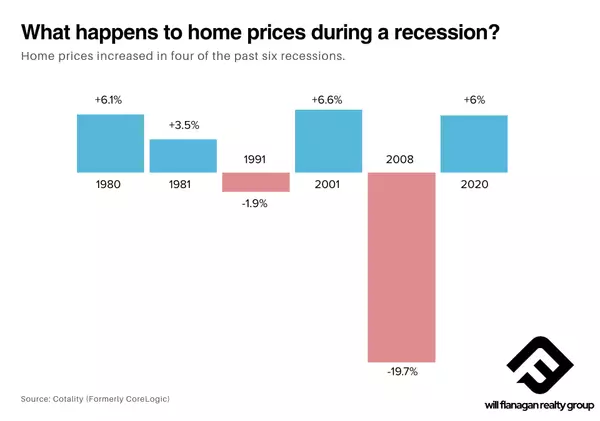

A real estate supercycle refers to a prolonged period of strong market growth, where demand and economic factors keep prices rising despite short-term interest rate changes or market corrections.

Tredway recently shared his perspective, stating:

“I would tell you we could be entering a supercycle for real estate just given the current policy, the facts that rates will come down at some point, and the demand drivers that we see in the economy.”

In other words, real estate values are positioned for long-term appreciation, even if rates don’t drop significantly in the near term.

What About Interest Rates?

If you’ve been following the market, you know interest rates have been a major factor in homebuying decisions. Many buyers and investors have been waiting for rates to drop before making a move.

But here’s the key takeaway:

Even if interest rates stay elevated in the short term, the demand for housing is so strong that property values are expected to keep rising.

Tredway pointed out that specific real estate sectors—such as housing, logistics, and industrial—are already experiencing high demand. Investors looking for long-term appreciation and strong rental cash flow are making moves now.

And if rates do drop? That’s just an extra boost to appreciation.

Oklahoma City’s Market: A Hidden Gem in the Supercycle?

While national trends are important, Oklahoma City’s housing market is uniquely positioned to benefit from this real estate supercycle.

✅ OKC’s Home Prices Are Still Below National Averages

• Unlike major coastal cities where prices have skyrocketed, Oklahoma City offers affordability paired with strong growth potential.

• The median home price in OKC remains lower than the national average, making it an attractive market for investors and first-time buyers.

✅ Strong Job Growth Is Driving Demand

• Major employers like Tinker Air Force Base, Amazon, and Boeing continue to expand, bringing new residents and housing demand.

• OKC’s tech and healthcare sectors are also growing, creating stable, high-paying jobs that drive homeownership demand.

✅ Rental Market Is Booming

• With high in-migration to Oklahoma City, rental demand is outpacing supply.

• Investors in multifamily properties, short-term rentals, and single-family rentals are seeing strong occupancy rates and rental increases.

✅ New Construction & Housing Shortages

• Like many U.S. markets, Oklahoma City is experiencing a housing shortage.

• New construction homes are selling fast, and builders are struggling to keep up with demand.

What to Expect in 2025: Home Price Growth & Investment Opportunities

According to J.P. Morgan’s latest housing market outlook, home prices are expected to rise by 3% in 2025.

📈 Why?

• Limited inventory means buyer competition will continue.

• Inflation and construction costs keep pushing prices higher.

• Job growth and population increase fuel long-term appreciation.

For those waiting on the sidelines, this means that what feels expensive today could look like a bargain in just a few years.

What This Means for Buyers & Investors

🔹 If You’re Buying a Home

• Waiting for rates to drop may cost you more in the long run.

• Property values are expected to rise, meaning affordability could get worse.

• Locking in a price now—even at higher rates—could be a smart move if long-term appreciation continues.

🔹 If You’re Investing

• The Oklahoma City rental market is booming, with strong occupancy rates and rising rents.

• Multifamily, single-family rentals, and short-term rentals remain strong cash-flowing opportunities.

• OKC’s economic expansion makes it an ideal long-term investment market.

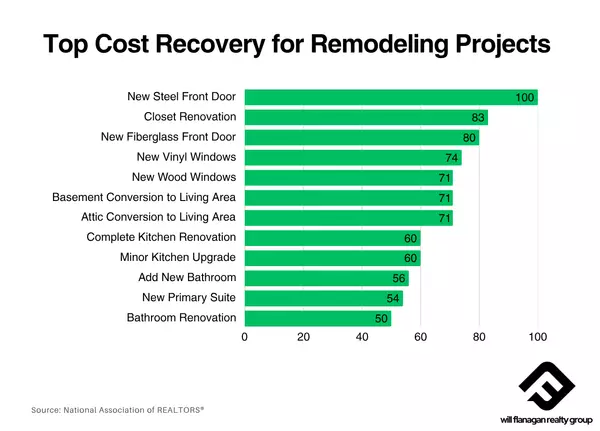

🔹 If You’re Selling a Home

• Home values are projected to increase, meaning buyers are still active despite higher interest rates.

• Marketing your home effectively (staging, professional photography, and strategic pricing) can help you attract serious buyers quickly.

Key Takeaways: The Supercycle is Here—Are You Ready?

✔️ A real estate supercycle could be underway, driven by strong demand and economic fundamentals.

✔️ Interest rates may not drop quickly, but home values are still poised for long-term growth.

✔️ Housing, industrial, and logistics sectors are already seeing strong investor confidence.

✔️ Oklahoma City’s market is uniquely positioned for growth, with affordable home prices, job expansion, and high rental demand.

✔️ Waiting for the “perfect” moment could mean missing out on today’s opportunities.

While some hesitate, those who understand market fundamentals are already making strategic moves.

What’s Next? Get Expert Guidance on Your Next Move

Whether you’re looking to buy, sell, or invest in Oklahoma City real estate, the right strategy is key.

At Will Flanagan Realty Group, we specialize in helping buyers and investors navigate the market with confidence.

📞 Call or text: 405-784-6580

📧 Email: will@willflanaganrealty.com

🌎 Visit us online: willflanaganrealty.com

💡 Thinking of selling? Get a free home valuation today. Click here to check your home’s value.

🚀 Don’t miss out on the opportunities this real estate supercycle presents. Take action today!

Categories

Recent Posts

GET MORE INFORMATION

Managing Partner | Realtor | License ID: 183611

+1(405) 784-6580 | will@willflanaganrealty.com