Breaking Down Housing Affordability in Oklahoma

What Does Housing Affordability Really Look Like in Oklahoma?

Spoiler alert: Housing affordability is not as simple as the headlines make it sound, especially here in Oklahoma City.

Depending on who you ask, the real issue is not just home prices or the number of homes on the market. It is about access, opportunity, and, most of all, what “affordable” really means for people trying to buy their first or next home.

So, what does affordability look like in Oklahoma right now? And where do you actually stand a chance of finding the right home at the right price?

Let’s dive in.

Inventory Crisis or Access Crisis?

If you have been following the national conversation, you have probably heard a lot about the so-called “housing shortage.”

But two of the sharpest minds in real estate data, Ivy Zelman and Logan Mohtashami, actually see it differently.

Ivy Zelman’s Take: It’s About Accessibility, Not Just Supply

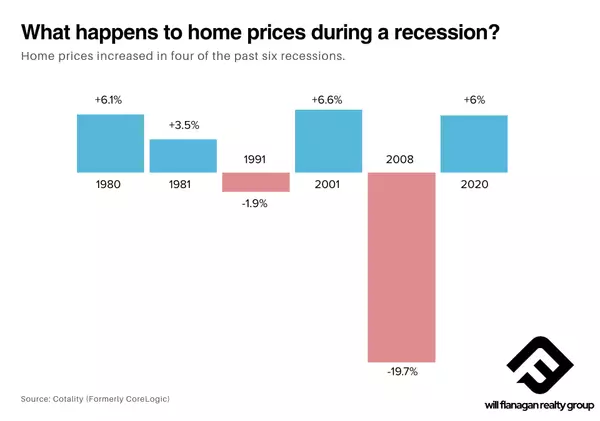

Ivy Zelman, famous for calling the 2008 housing crash years in advance, argues that the bigger issue today is not necessarily inventory.

It is affordability.

In her words:

“You could talk as much as you want about how many units might be short, but if you cannot offer a mortgage payment that people can afford, who really cares?”

Zelman points out that many young adults graduating college right now struggle to afford renting their own apartment, much less buying a home. Even in markets that technically have available homes, there is a gap between what is available and what is attainable.

Logan Mohtashami’s Take: Affordability Has Always Been a Challenge

Housing market analyst Logan Mohtashami brings another perspective:

“When was housing ever affordable?”

Home prices have historically risen during inflationary periods, from the 1940s through the pandemic years. According to Mohtashami, waiting for a massive price drop is not a strategy, it is wishful thinking.

Instead, buyers have historically made it work by combining incomes, adjusting expectations on location or size, and being flexible.

And that is exactly what we are seeing here in Oklahoma City today.

How Does Oklahoma Compare?

While national experts debate the “why,” Realtor.com recently graded every state with their Housing Affordability Report Card.

Oklahoma came in strong.

🏡 Grade: B+

💵 Median Home Price: About $262,000 (well below the national average)

📈 Affordability Score: Oklahoma remains one of the most affordable states, with median earners spending just about 24% of their income on a median-priced home

🏗️ New Construction: Oklahoma is seeing strong building activity relative to population size, helping us stay competitive

Translation: Oklahoma remains one of the most attainable housing markets in the country, especially compared to pricier states like California, Colorado, or even nearby Texas.

What Housing Affordability Looks Like in Oklahoma City

Statewide numbers tell one story, but the real story is what is happening right here in OKC.

In the Oklahoma City metro, affordability looks very different depending on where you are looking.

Here is what is happening on the ground:

-

🏡 First-time buyers are finding wins in areas like Mustang, Yukon, and South OKC, where you can still find move-in-ready homes under $275,000

-

🛠️ Builder incentives are back, with rate buydown offers, closing cost help, and free upgrades in new communities across Edmond, Deer Creek, and Moore

-

🏘️ Up-and-coming neighborhoods like the Plaza District and Capitol Hill are offering strong opportunities, especially for buyers willing to consider smaller homes, townhomes, or updated historic properties

-

🎯 Down Payment Assistance Programs are available through programs like OHFA and REI Down Payment Assistance, offering grants or low-interest loans to help buyers get in the door with less cash upfront

In short, buyers who are flexible, creative, and well-informed have a huge advantage right now in Oklahoma City.

The Good News: You Can Make It Happen

Yes, home prices have climbed.

Yes, mortgage rates are higher than we would all like.

But homeownership in Oklahoma City is still absolutely achievable with the right strategy.

Here is what is working for buyers right now:

✅ Getting crystal-clear on their budget early and setting realistic search parameters

✅ Exploring all financing options, including FHA, VA, OHFA bond loans, and builder incentives

✅ Being flexible on location or home features, sometimes a slightly longer commute can save you $30,000 or more on purchase price

✅ Locking in a lower monthly payment with rate buydown programs, especially on new builds

Thinking About Buying a Home in Oklahoma City?

Whether you are just starting to dream or you are ready to make a move, having the right local guide makes all the difference.

At Will Flanagan Realty Group, we know the OKC market inside and out. We will help you find the right home at the right price without getting overwhelmed in the process.

🏡 Ready to explore your options?

📲 Contact us today at 405-784-6580 or click here to schedule your free consultation!

Let’s make homeownership happen for you in 2025.

Categories

Recent Posts

GET MORE INFORMATION

Managing Partner | Realtor | License ID: 183611

+1(405) 784-6580 | will@willflanaganrealty.com