First-Time Homebuyer Guide: 2025 Oklahoma City Edition

First-Time Homebuyer Guide: 2025 Oklahoma City Edition

Buying your first home is equal parts thrilling and terrifying. You’re probably excited about picking paint colors, but also sweating the thought of mortgage payments. Here’s the thing: every first-time buyer feels that way. The difference between panic and confidence is having a roadmap—and this guide is your GPS.

👉 Ready for the full details? Download the 2025 First-Time Homebuyer Guide.

Renting vs. Buying: The Real Numbers

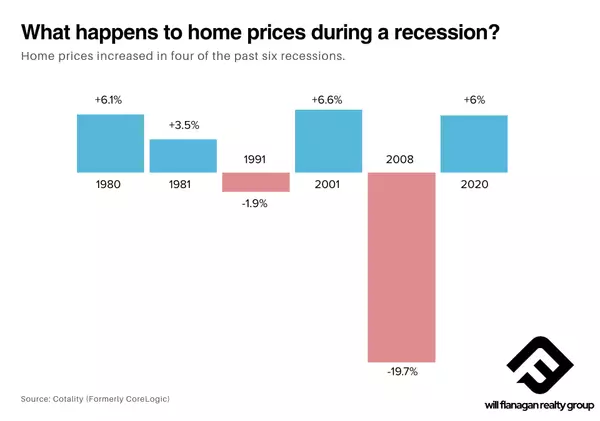

Renting feels flexible, but it comes with a long-term price tag: rising costs and no equity. Data shows rents have steadily increased for decades . Meanwhile, buying lets you build wealth over time as your home’s value grows.

📊 Compare the market yourself in our OKC Market Snapshot.

Credit Scores, Student Loans, and Other Myths

Good news: you don’t need perfect credit to buy a home. The average first-time buyer score is in the mid-600s . Even student loans don’t block you—32% of recent first-time buyers had them and still bought .

👉 Talk to us about local lenders and get pre-approved before house hunting.

Down Payment Truth Bomb

Forget the 20% myth. The median down payment for first-time buyers is just 9% —and many qualify for programs that reduce that further. Almost 80% of buyers qualify for down payment assistance, but only 13% use it .

💡 Want to maximize your buying power? Start with our Buyer’s Guide to see all your options.

The Pre-Approval Advantage

Pre-approval isn’t optional anymore—it’s your golden ticket. Sellers take your offer seriously when you’ve got that letter in hand . It’s the difference between winning and losing in today’s competitive market.

📘 Check your financial readiness with our Oklahoma City Home Valuation tool if you’re selling and buying.

Smart Search Strategies

Affordability is tough, but options exist:

-

Fixer-uppers (29% cheaper than move-in ready homes)

-

Townhomes (lower cost entry point)

-

Multi-generational homes (shared costs with family/friends)

👉 Browse the latest Oklahoma City listings to see what’s out there.

Why You Need an Agent from Day One

Buying a home comes with inspections, contracts, negotiations, and lender chaos. You don’t want to wing it. A seasoned OKC agent:

-

Explains market trends in plain English

-

Negotiates repairs and concessions on your behalf

-

Guides you through legal documents without the fine print headaches

👉 Thinking about selling down the road too? Check our Fall 2025 Seller’s Guide.

Final Word for First-Time Buyers

Your first home is more than a transaction—it’s your foundation for the future. Don’t wait for “perfect” timing or perfect credit. The right strategy, the right agent, and the right game plan make it possible today.

✅ Download the full First-Time Homebuyer Guide

📅 Schedule your consultation to get a step-by-step plan

Categories

Recent Posts

GET MORE INFORMATION

Managing Partner | Realtor | License ID: 183611

+1(405) 784-6580 | will@willflanaganrealty.com